Invest Politically aligns your investment portfolio with Republican values.

Elections have consequences. Are your investments aligned with your political beliefs? Through the Politically Responsible Investing® strategy you can now align your portfolio with your Republican vote. Have you ever decided against buying a product or service because the company is publicly against your political views? The MAGA ETF goes beyond product protest to invest in companies that are highly supportive of Republican candidates for public office.

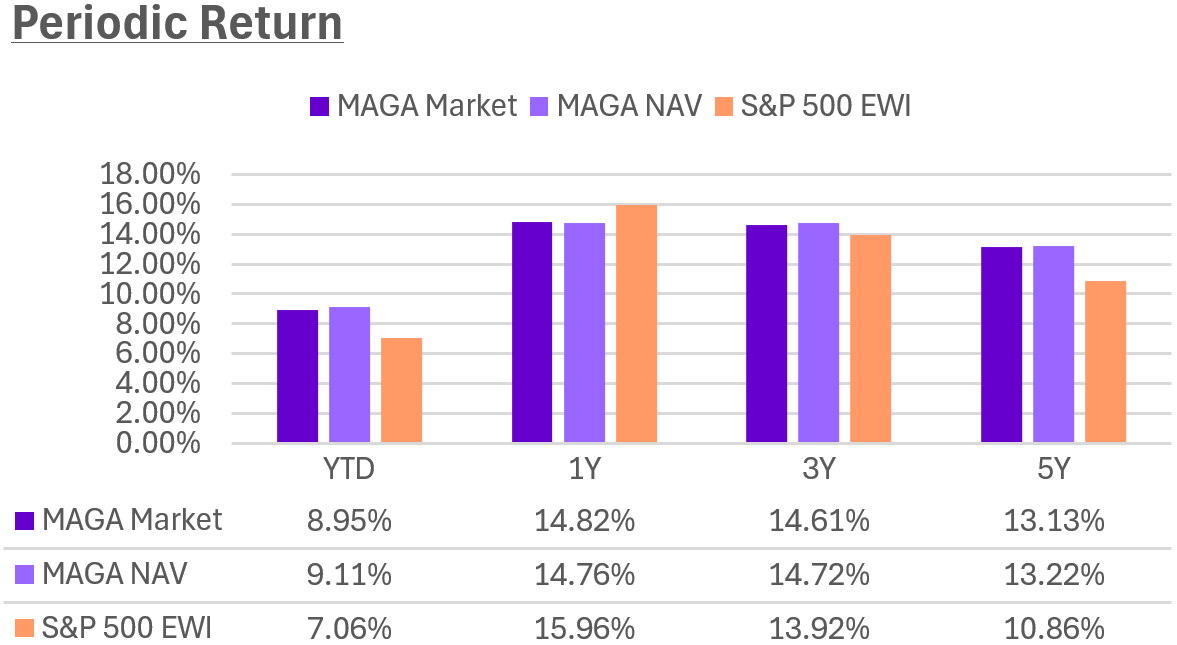

America First, Profits First: MAGA ETF Outperforms the Equally Weighted S&P 500 Over 5 Years

PBC America First ETF (ticker: MAGA) Has Outperformed the S&P 500 Equal Weight Index (EWI) Over 5 Years

Data as of: February 28, 2026

The 1-Year Total Return of the S&P 500 EWI through 12/31/2025 is 11.43%

The 5-Year Total Return of the S&P 500 EWI through 12/31/2025 is 10.48%

The Since-Inception Total Return of the S&P 500 EWI through 12/31/2025 is 12.26%

Performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. Total annual operating expenses are 0.72%. For standardized performance, click here.

Shares are bought and sold at market price (closing price) not net asset value (NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Click here to learn more about MAGA.

Many Republican clients want their investments to reflect their political views.

Do you know where to invest for them?

Individual investors and RIAs alike face overwhelming amounts of companies and information to sift through.

It can be difficult to source and vet the largest companies who support electing Republicans to office.

Enter the MAGA ETF.

The Point Bridge America First ETF (MAGA) uses an objective, rules-based methodology to track the performance of U.S. companies:

-

whose employees and political action committees (“PACs”) are highly supportive of Republican candidates for federal office, and

-

have U.S. assets greater than or equal to 50% of total assets, which serves to gauge a company’s investment in America and her citizens.

In our view, that’s putting America First.

We equally weigh our index—unlike the S&P 500 Index where a few mega caps dominate the performance, or the lack thereof.

And when equally weighted, the S&P 500’s performance historically falls behind MAGA.

The MAGA ETF prioritizes America First over elitist activism.

Republicans now have a political option on where to invest their money.

Click here to learn more about MAGA.

Why Invest Politically?

Performance and holdings discussed were as of January 18, 2018, and are no guarantee of future results. Current holdings and standardized performance are available at the Fund Summary page.

Fund Summary

1 Year Performance through 12/31/2025: Market 10.33% NAV 10.21%

5 Year Performance through 12/31/2025: Market 13.05% NAV 13.05%

Since Inception Performance through 12/31/2025: Market 10.86% NAV 10.84%

Performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than performance data quoted. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than original cost. Total annual operating expenses are 0.72%. For most recent month-end performance, click here

Learn how to bring your Republican investment values to life.

We would love to stay connected, so together we can make America great. Learn how your investments can incorporate your conservative values. Invest Politically has taken a new approach with the investment strategy of the MAGA ETF. We will send you an up-to-date fact sheet about the MAGA ETF as well as unique conservative content.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund’s prospectus. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Mid-capitalization companies may be more vulnerable to adverse business or economic events than larger, more established companies. The Fund is non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a smaller number of issuers than a fund that invests more widely. This may increase the Fund’s volatility and cause the performance of a relatively smaller number of issuers to have a greater impact on the Fund’s performance. Index composition is heavily dependent on quantitative models and data supplied by third parties. Where such models and data are incorrect or incomplete, the composition of the Index will reflect such errors and likewise the Fund’s portfolio. Because the methodology of the Index selects securities of issuers for non-financial reasons, the Fund may underperform the broader equity market or other funds that do not utilize similar criteria when selecting investments. The Fund is not actively managed and therefore would not sell shares of an equity security unless that security is removed from the Index or the selling of shares is otherwise required upon a rebalancing of the Index. Real Estate investments are subject to changes in economic conditions, credit risk, and interest rate fluctuations.

Shares are bought and sold at market price (closing price), not net asset value (NAV), and are not individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00 pm ET when NAV is typically calculated. Brokerage commissions will reduce returns.

Median 30 Day Spread is a calculation of Fund’s median bid-ask spread, expressed as a percentage rounded to the nearest hundredth, computed by: identifying the Fund’s national best bid and national best offer as of the end of each 10 second interval during each trading day of the last 30 calendar days; dividing the difference between each such bid and offer by the midpoint of the national best bid and national best offer; and identifying the median of those values.

Point Bridge Capital, LLC serves as the investment advisor, and Vident Investment Advisory, LLC serves as the sub-advisor to the fund. The fund is distributed by Foreside Fund Services, LLC, which is not affiliated with Point Bridge Capital, LLC or Vident Investment Advisory, LLC. TD Ameritrade, Edward Jones, E*Trade, Fidelity, and Charles Schwab are not affiliated with Point Bridge Capital, LLC, Vident Investment Advisory, LLC, or Foreside Fund Services, LLC.